FX Focus: USD, GBP, NZD and THB

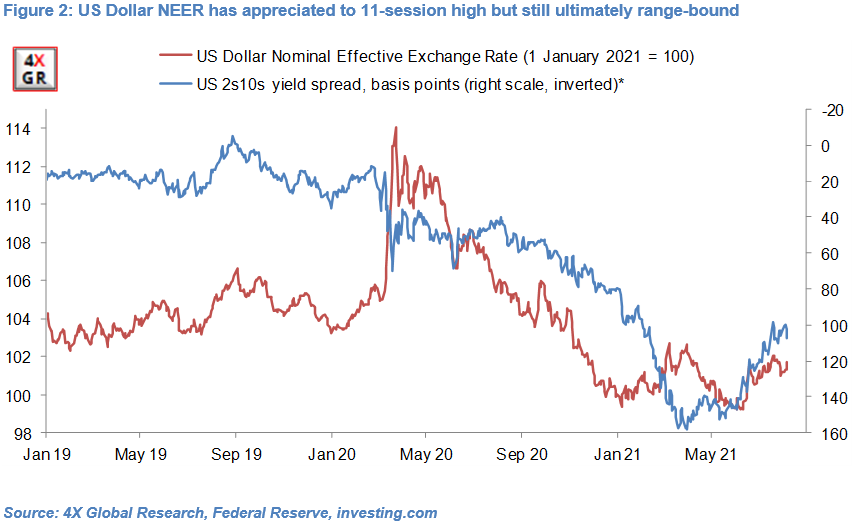

US Treasury yields and the Dollar, perhaps unsurprisingly, have risen in the wake of today’s strong US labour market report.

However, we think it would be a stretch to argue that markets have “hard-baked” in their view that the Federal Reserve will announce its tapering plans potentially as early as the Jackson Jackson Hole Symposium on 26-28 August. A case perhaps of once bitten twice shy and for good reason in our view.

We have been moderately bullish the GBP/EUR cross since late-June and the cross briefly traded above 1.18 this afternoon, its strongest level since February 2020. We maintain a positive outlook in the remainder of Q3.

The Kiwi Dollar has been the fourth strongest major currency since the Federal Reserve’s policy meeting on 16th June. The Kiwi Dollar NEER has so far in August appreciated about 0.9%, confounding historical patterns which on average in 2010-2019 saw the currency weaken 0.9% in the month of August.

However, the currency may not fare quite as well in Q4, in our view – the theme of our next FIRMS report.

Conversely, the Thai Baht has underperformed but it’s not just been a tourism issue.

Read the full article here

Olivier is an economist and rates & FX strategist with over 22 years experience in financial markets. He is Director and Founder of 4X Global Research, an independent, London-based consultancy which provides institutional and corporate clients with substantive research, high-quality analysis and insight on emerging and G20 economies and financial markets.