Looking beyond perfect Sterling Storm

It is now three years since the referendum on 23rd June 2016 in which 52% of the British electorate voted for the UK to exit the EU. The issue of whether, when and how the UK will leave the EU has shaped the UK’s political agenda and economic and social landscape.

The chronic uncertainty associated with Brexit has had a significant negative impact on the UK’s key balance of payments flows and in turn Sterling, with the Nominal Effective Exchange Rate still 14% weaker than pre referendum. Brexit has both weighed directly on net foreign direct investment, inflows into gilts and UK equities and other financial flows, and indirectly via its drag on UK GDP growth.

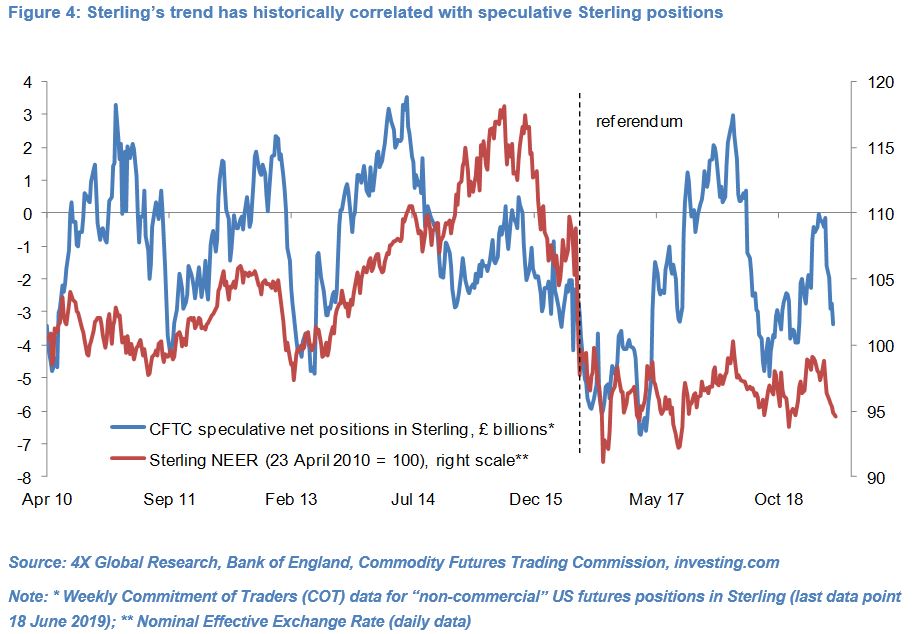

Speculative short Sterling positions fell from £3.9bn in mid-January to £0.3bn in early May and the Sterling NEER appreciated about 4%, thanks to i) shrinking odds of a “no-deal” Brexit following critical parliamentary votes in Q1 and pro-EU parties’ strong showing in British local elections on 2nd May, ii) UK GDP growth rising to 0.5% qoq Q1 and iii) the Bank of England becoming more hawkish.

However, speculative short Sterling positions have since surged to £3.4bn (as of 18 June) and Sterling depreciated 4.8%. Markets are digesting the Brexit Party’s strong showing at the European Parliament elections on 24th May and the commitment by Boris Johnson, the front-runner to succeed Prime Minister May, to take the UK out of the EU by 31st October with or without a deal. Moreover, UK GDP growth likely slowed sharply in Q2 and we maintain our forecast that there is little chance of a policy rate hike any time soon.

Near-term, we expect Brexit convolutions, a more dovish Bank of England and unfavourable seasonal patterns to keep a volatile Sterling under modest pressure. Furthermore, the underlying trade deficit has increased in the past three years to around £9bn per quarter. Despite Sterling’s significant competitiveness gain post referendum, there is little evidence of UK exporters winning market share or of import substitution.

However, we maintain our long-held view that the path of least resistance for the incoming prime minister will be to again delay the UK’s exit from the EU and call a confirmatory second referendum – a path which would see Sterling appreciate materially.

This is a summary – Read the full research piece here

Olivier is an economist and rates & FX strategist with over 22 years experience in financial markets. He is Director and Founder of 4X Global Research, an independent, London-based consultancy which provides institutional and corporate clients with substantive research, high-quality analysis and insight on emerging and G20 economies and financial markets.