Not all weeks are made the same

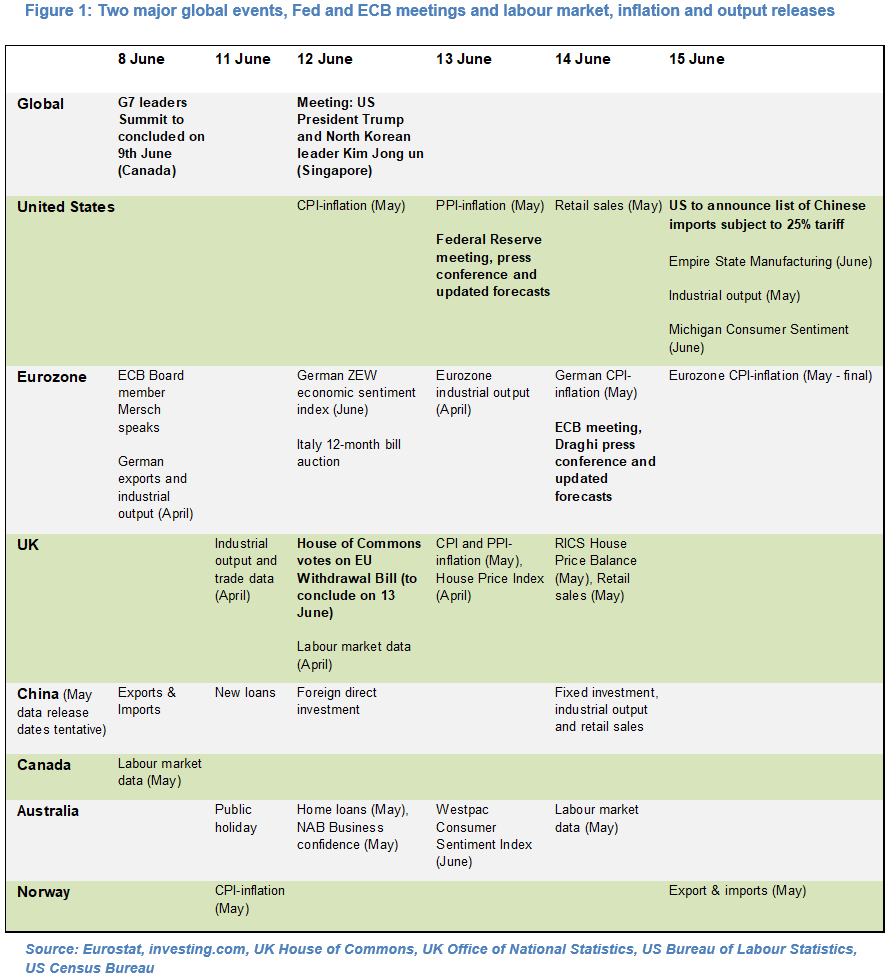

The next eight days could prove pivotal for global markets. At the very least the G7 Leaders Summit (8-9 June) and meeting between Trump and Kim Jong un (12th June), Fed and ECB meetings and tier-1 macro data could set the tone near-term for currencies which in recent weeks have alternated between schizophrenic and composed.

G7 Summits have in recent years over-promised and under-delivered but this time may be different given the complex and fast-moving geopolitical backdrop. The recent G7 Finance Minister and Central Bank Governor meetings certainly point to the issue of global trade superseding the official agenda.

US tariffs on imports from the EU, Canada and Mexico are unlikely to materially impact these countries’ economic growth and inflation trajectories but the concern is that a full-blown trade war would further dent slowing global trade growth and flat-lining GDP growth.

This is unlikely to deter President Trump given the United States’ widening $570bn trade deficit, particularly if he feels cornered. This could in turn rattle equity markets and an already under pressure Mexican Peso and stymie any upward trend in the range-bound Canadian Dollar and recovering Euro.

The run-up to the historic Summit between US President Trump and North Korean leader Kim Jong un in Singapore on 12th June has been a long and rocky road and it is still unclear what both leaders can credibly achieve and importantly implement.

However, both sides have arguably invested much political capital and will be loathe to walk away without at the very least some headline-grabbing “victories”. Moreover, US President Trump will want to regain the initiative from China and South Korea.

Short of Trump and Kim Jong un walking away from this summit empty handed, it is conceivable that the appreciating Korean Won may get another leg up. However, whatever is promised during this summit should in our view be taken with a large pinch of salt.

Our next report will look at the FX implications of forthcoming Fed and ECB meetings, British parliamentary votes on EU withdrawal bill and key macro data in major economies.

This is a summary – Read the full research piece here

Olivier is an economist and rates & FX strategist with over 22 years experience in financial markets. He is Director and Founder of 4X Global Research, an independent, London-based consultancy which provides institutional and corporate clients with substantive research, high-quality analysis and insight on emerging and G20 economies and financial markets.